XRP Price Reality Check: SEC Win Doesn’t Guarantee Skyrocketing

Reason to trust

We adhere to a strict editorial policy that prioritizes accuracy, relevance, and impartiality.

Our content is created by seasoned industry experts and goes through a meticulous review process.

We are committed to upholding the highest standards in both reporting and publishing.

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

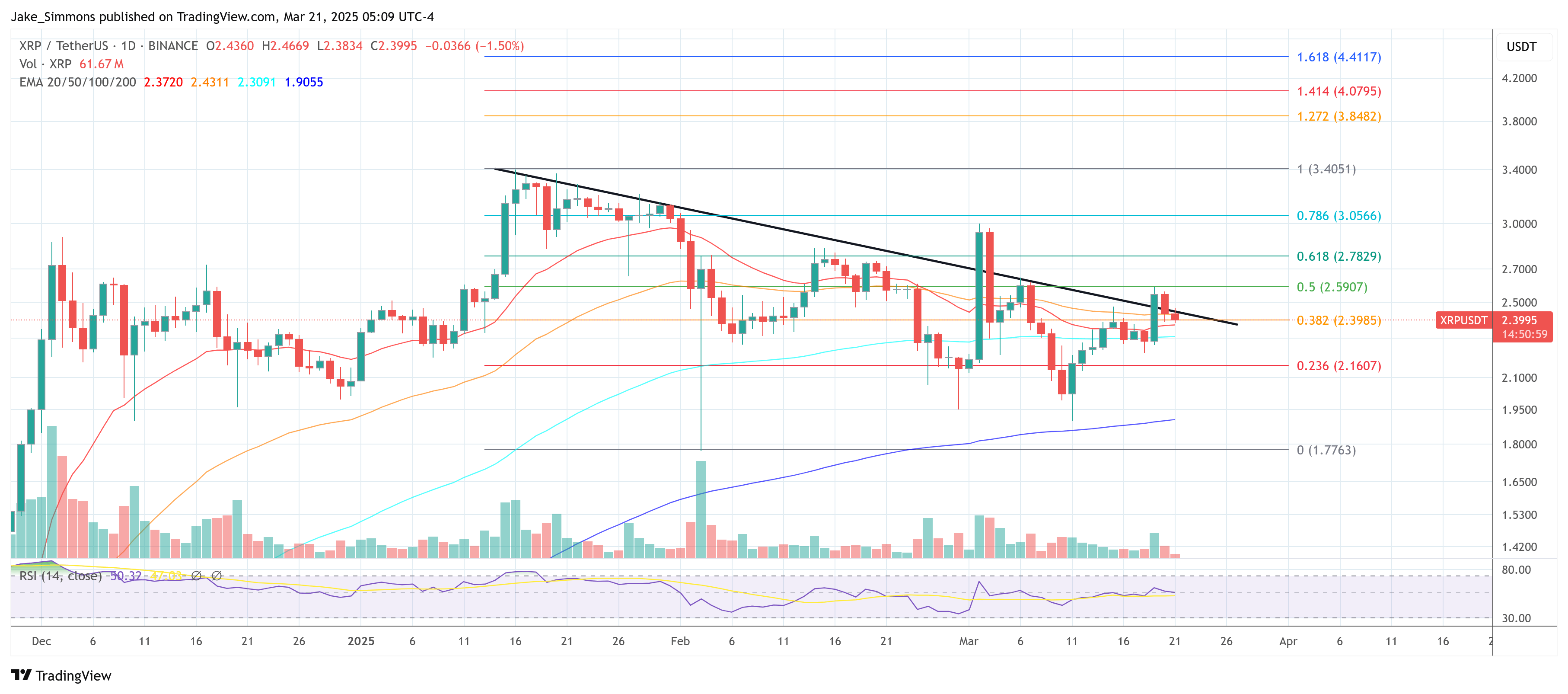

Despite Ripple’s legal win against the US Securities and Exchange Commission (SEC), the XRP price hasn’t exploded as many anticipated. After the SEC officially dropped its appeal, a lot of market watchers were betting on a surge to a new all-time high for XRP. Instead, we saw a more modest climb of only 13%, peaking around $2.60 before settling back to about $2.40. This has left investors, who were hoping for a much bigger rally, scratching their heads.

Why Is XRP Not Skyrocketing?

Johnny Krypto, co-founder of Merlin, suggests that the somewhat underwhelming price action of XRP shouldn’t be too surprising. He points out historical patterns in both the crypto world and traditional markets, noting that when news is widely expected, the actual event often leads to a less dramatic market response due to anticipatory trading. “When Trump won, there wasn’t really a fundamental reason for XRP’s price to suddenly jump,” Johnny explains, “but the market had already priced in the expectation that the lawsuit would be dropped. That’s why we saw that significant price pump beforehand.”

Related Reading

He clarifies that the price increase from $0.50 to $2.50 last November was largely fueled by traders who were betting on a favorable outcome for Ripple in its legal battle. Now that the positive resolution is reality, the market’s reaction is more of a quiet sigh of relief than a celebratory roar. “If the SEC had decided to continue with the appeal, XRP’s price would likely have plummeted, rather than just staying relatively stable,” he adds. Essentially, the lack of bad news has prevented a price drop, but it hasn’t necessarily triggered a surge to new peaks as some hoped.

Crypto analyst EGRAG CRYPTO (@egragcrypto) commented on X, highlighting a wave of anxiety within the XRP community. He argues that many investors are feeling uneasy because of the current price stability and the market’s more gradual pace compared to previous, more volatile cycles. “Right now, it feels like almost everyone is in a state of panic. Even with my optimistic charts, some people are still worried. My DMs are full of questions like: ‘The SEC dropped the case, and we *didn’t* MOON. Why? What’s going on? What Happened?’ Just relax and breathe! The real bull market and development are only just beginning.”

He emphasizes that this slower, steadier price movement can be challenging for retail investors, who are often looking for quicker and more dramatic returns. “Currently, it seems almost all retail players are experiencing ‘pain’ – what we might call the pain of boredom. Unlike in 2017, where the market saw rapid ups and downs, this time the changes are unfolding at a slower pace… But financial markets just don’t work like that. They move in cycles and waves.”

Related Reading

Looking ahead to the anticipated entry of large institutional investors, EGRAG CRYPTO remains optimistic. “This time around, the market could stay strong for a longer period because of these more stable prices. New ETFs will play a role in bringing in a new wave of participants… There will be countless salespeople promoting XRP ETFs to their clients.” His core message to XRP holders is clear: patience is key.

Beyond the legal wins and losses, XRP, like the wider cryptocurrency market, is still influenced by global economic trends. The potential for a US-led trade war, possibly driven by President Trump’s tariff policies, is a significant factor looming on the horizon. Specifically, the proposed 25% tariffs on goods from Canada and Mexico, along with a 10% tariff on China, have heightened fears about stagflation – that tricky combination of slow economic growth and high inflation.

Supply chain problems, rising consumer costs, and a general weakening of economic momentum are all putting pressure on riskier markets. As a result, investors are increasingly looking towards “safe haven” assets, like US Treasuries and gold, which in turn reduces demand for more volatile assets like XRP.

The Federal Reserve’s approach to monetary policy is also shaping market sentiment. At their meeting on March 19, 2025, the Fed decided to hold interest rates steady in the 4.25%–4.5% range that was set in late 2024, pausing the rate-cutting cycle that started in September 2024. Fed Chair Jerome Powell cited persistent inflation that was still above the 2% target, alongside increased worries about a potential recession, partly linked to tariff concerns and weaker consumer spending.

Powell’s cautious outlook has contributed to growing unease in the market, as a recession could further erode confidence in risk assets. In this kind of economic climate, even the positive news of the XRP lawsuit resolution might not be enough to fuel a lasting price surge.

As of writing, XRP is trading at $2.3995.

Featured image created with DALL.E, chart from TradingView.com