XRP Price Surge: 1% SWIFT Volume Could Trigger Massive Gains

Could XRP’s price skyrocket? Imagine if it simply assisted SWIFT by processing just 1% of their daily global transactions!

The crypto world has been buzzing about XRP and its potential role in international payments, especially when we talk about how it might relate to SWIFT, the giant in financial messaging.

Could XRP Work Alongside SWIFT?

Many experts in the industry, including people at Ripple itself, have been discussing if XRP and the XRP Ledger (XRPL) could either complement SWIFT or even become the go-to for cross-border transactions.

For example, Ripple CEO Brad Garlinghouse pointed out at the Paris Fintech Forum in 2019 that they aren’t necessarily trying to replace SWIFT, but rather make it work better. He gave a nod to SWIFT’s Global Payments Innovation (GPI) for moving in the right direction but emphasized that Ripple’s blockchain solutions offer even greater efficiency.

Back in 2018, during a conversation at Money20/20 USA, Ripple’s CTO, David Schwartz, highlighted how XRP could cut down the need for intermediaries. He noted that traditional payments often suffer from being slow and expensive. It’s not just Ripple execs thinking this way; various analysts have echoed these thoughts.

SWIFT’s Enormous Transaction Volume

To put things into perspective, SWIFT handles a truly massive number of transactions every day. In December 2022, they were processing an average of 44.8 million FIN messages daily, which is a 6.6% jump from the year before.

While SWIFT keeps the total value of these transactions private, past estimates give us an idea of just how significant it is. Around 2004, SWIFT was processing about 10 million messages each day, with each message averaging roughly $500,000 in value, totaling around a staggering $5 trillion daily.

Even with all the talk about XRP potentially working alongside SWIFT, it’s still unclear exactly how this would impact XRP’s market value. To get some clues, we used ChatGPT, an AI chatbot, to explore some possible scenarios if XRP were to handle just 1% of SWIFT’s daily transaction volume.

What if XRP Handled Just 1% of SWIFT’s Daily Volume?

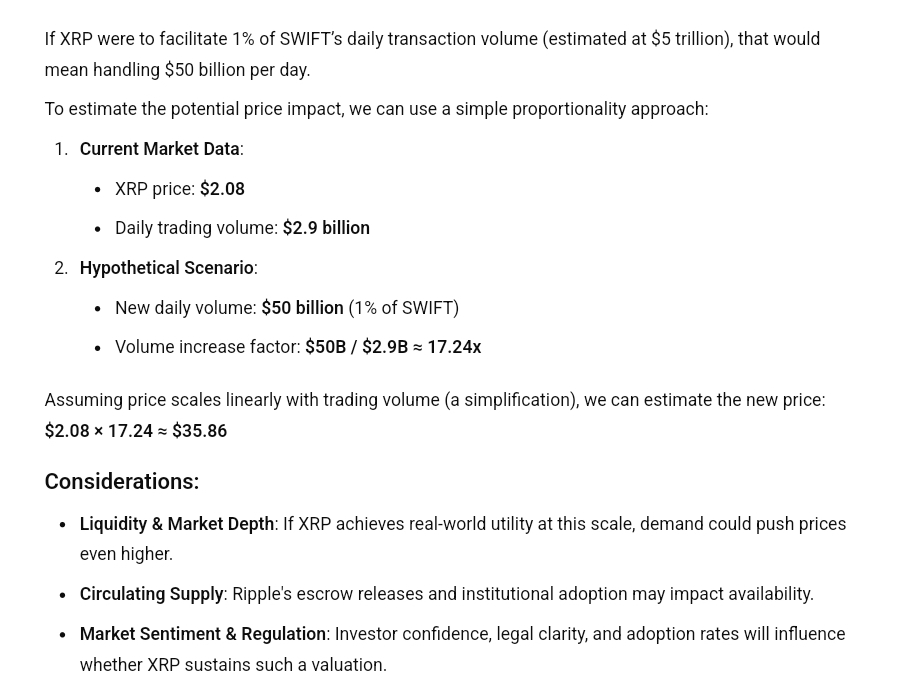

According to the chatbot’s predictions, if XRP facilitated just 1% of SWIFT’s estimated $5 trillion daily volume, it would be processing $50 billion in transactions every single day. To figure out the potential price change, it used a simple comparison, looking at XRP’s current market stats against this hypothetical, busier situation.

When this analysis was done, XRP was trading at $2.08, with a daily trading volume of $2.9 billion. If XRP’s daily transaction volume were to jump to $50 billion in our hypothetical scenario, the volume would increase by about 17.24 times its current level.

Then, ChatGPT made a big assumption – that price directly follows trading volume – and estimated XRP’s price could jump to around $35.86 in this scenario! Incredible, right? That would be a massive 1,624% pump from XRP’s current price, pushing its market cap way past $2 trillion.

However, it’s really important to remember that this is a super simplified view. In reality, things aren’t this cut and dry. Just because trading volume increases doesn’t automatically mean the price will shoot up by the same amount. Lots of that extra volume could easily come from people selling off their XRP too.

Disclaimer: This content is for informational purposes only and shouldn’t be seen as financial advice. The opinions in this article might be the author’s own and don’t necessarily reflect the view of The Crypto Basic. Always do your own thorough research before making any investments. The Crypto Basic is not responsible for any money lost.