Bitcoin ETF Outflows Surge, BlackRock in Focus

Bitcoin ETF Outflows Surge, BlackRock in Focus

2025 continues to be a rollercoaster for the crypto market, especially for Bitcoin (BTC). We’re seeing wild price swings, sometimes as much as 10% in rapid succession, and mind-boggling liquidations reaching billions nearly every weekend. Add to that major developments, like the US government establishing a Strategic Bitcoin Reserve, and it’s no wonder people are scratching their heads, trying to figure out where the market is headed.

If there’s one constant in the market right now, it’s definitely instability. What’s bad about it is that in such uncertain times, many investors are understandably hesitant to ride out the volatility and, judging by recent trends, prefer to stay on the sidelines. You can really see this playing out in the Bitcoin ETF world.

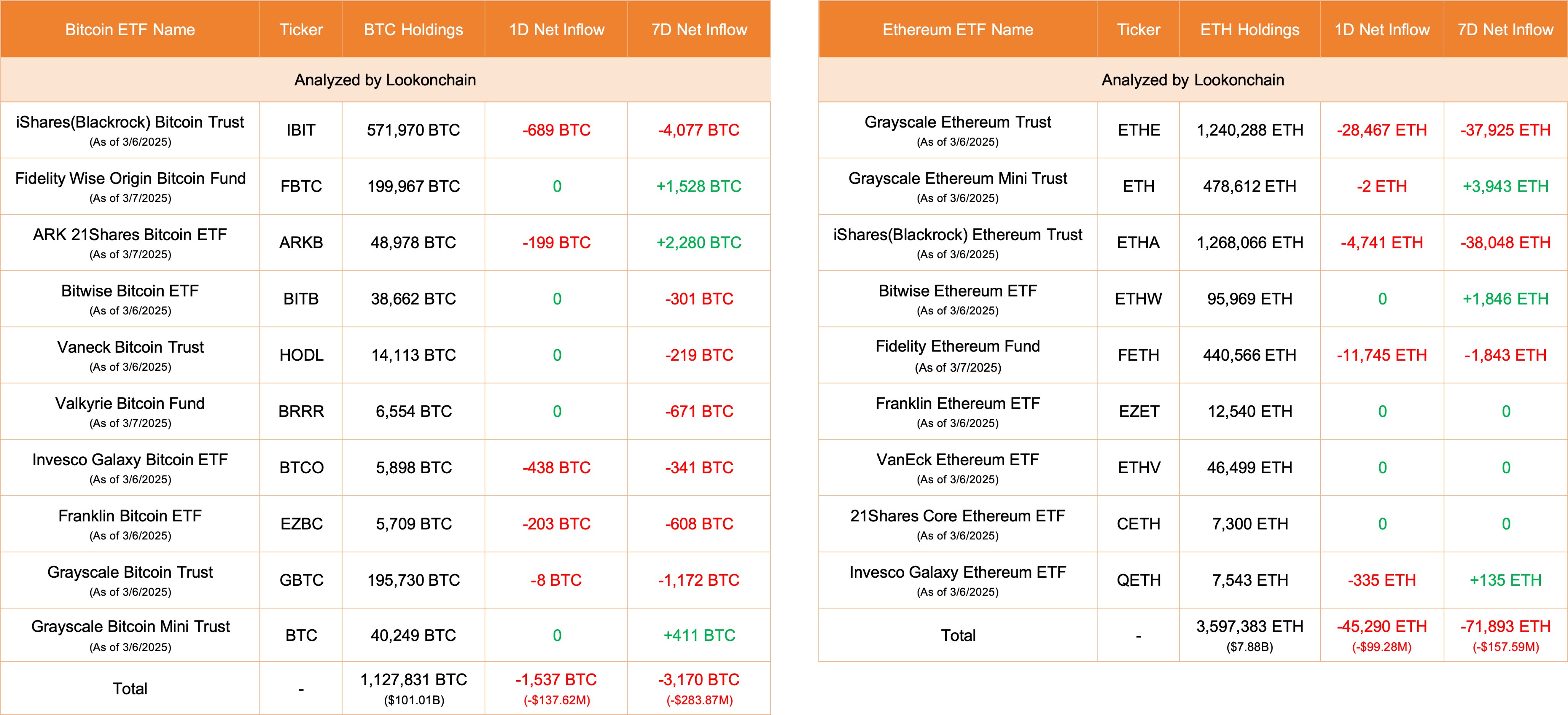

For instance, recent data from Lookonchain shows that in the last 24 hours, Bitcoin ETF experienced another wave of outflows, amounting to a net -$137.62 million, or the equivalent of 1,537 BTC.

Just last week, the market saw outflows exceeding $2.9 billion, and it seems this outflow trend isn’t reversing yet.

IBIT, BlackRock’s Bitcoin ETF, experienced the largest outflows in the last 24 hours. The financial giant with $10 trillion under management saw 689 BTC leave its holdings, roughly $61.7 million in value.

Essentially, this figure shows that IBIT ETF holders were selling.