Worldcoin Breakout Watch: WLD Challenges Key Resistance

- Keep your eyes peeled! Worldcoin’s price is nearing crucial levels, hinting at a possible surge towards $2.80.

- Things are heating up for WLD! We’re seeing more and more active addresses and transactions, showing growing interest from everyday investors and solid market backing.

Worldcoin [WLD] is currently trading around $1.26, a 3.50% jump since yesterday, and it’s reached a really interesting turning point in its price movement.

Right now, the price is testing the middle ground of a descending channel pattern. This is a key moment – will it break upwards, or will the downward trend continue?

With important support and resistance levels now in play, traders are on the edge of their seats, wondering if WLD has the strength to push higher.

If WLD can smash through these significant resistance barriers, we could see it aiming for that $2.80 mark, potentially offering some pretty sweet gains.

Key levels to watch: Can WLD break free from its downtrend?

Over the past few weeks, WLD’s price action has been like a ship sailing within a channel that’s been trending downwards. We’ve got some key levels forming both at the top and bottom of this range.

Right now, solid support seems to be hanging around the $1.25–$1.30 area. If WLD can hold steady above this zone, it could be the spark to ignite a bullish rally.

However, to really kick things into high gear and aim for bigger targets, WLD needs to break past the $1.35–$1.50 resistance range. If it manages to do that, then the next levels to keep an eye on are $1.65, $1.95, and potentially reaching up to $2.80.

Source: TradingView

WLD’s rising addresses suggest…

There’s a lot more buzz around Worldcoin lately! The network’s been buzzing with activity, with a significant 45.05% jump in Active Addresses just in the last week. Plus, we’ve seen a whopping 106.98% increase in new addresses, which really signals growing interest in what Worldcoin’s up to.

Typically, this kind of sharp uptick in activity is seen as a positive sign, suggesting there’s more and more demand for WLD.

If this energy keeps up, it could definitely fuel a potential breakout, as more and more traders and investors get involved with the network.

Source: IntoTheBlock

How are market participants reacting?

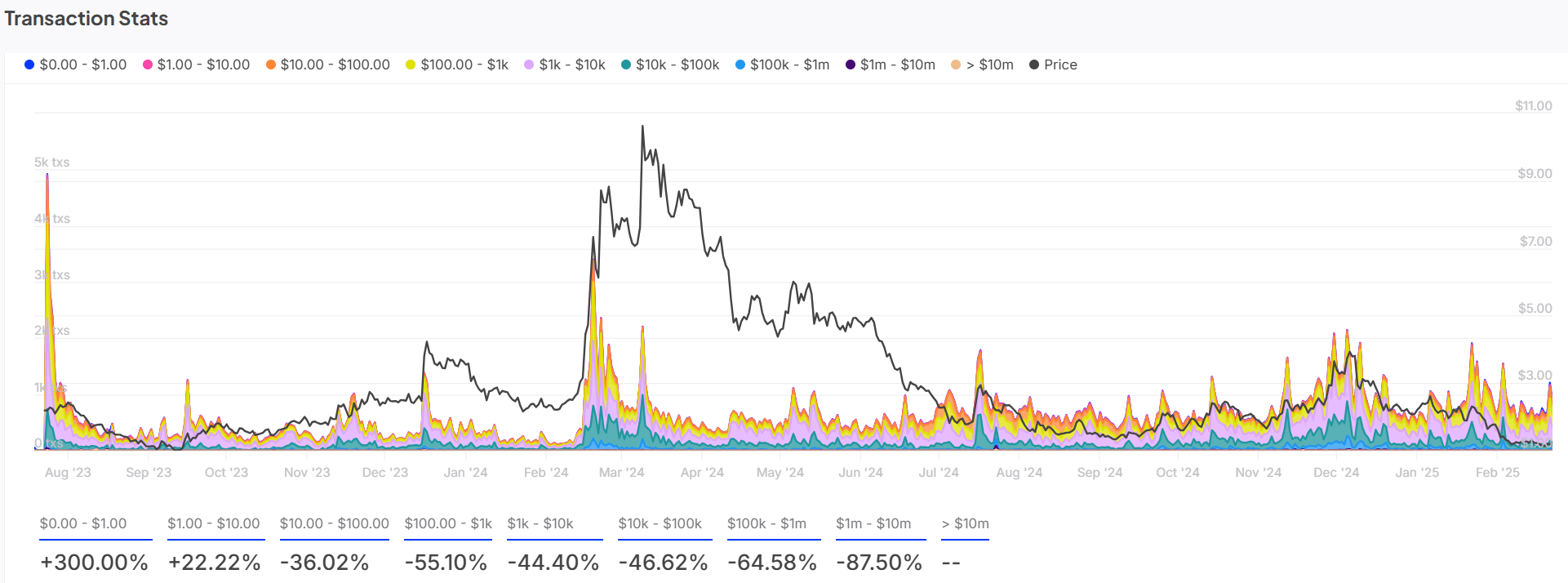

Let’s dig into the transaction numbers for a clearer picture of how the market feels about WLD right now.

Even though the price has been dipping, smaller transactions are really active. Interestingly, transactions in the $0.00–$1.00 range have skyrocketed by a massive 300%!

This surge suggests that smaller, everyday investors are getting more involved, likely positioning themselves to capitalize on a potential price breakout.

On the flip side, larger transactions, especially those in the $10M–$100M range, have actually decreased by 64.58%. This might mean institutional players are taking a bit of a breather.

However, the strong showing from retail investors indicates that Worldcoin might just have the grassroots support it needs to climb upwards, should this breakout opportunity materialize.

Source: IntoTheBlock

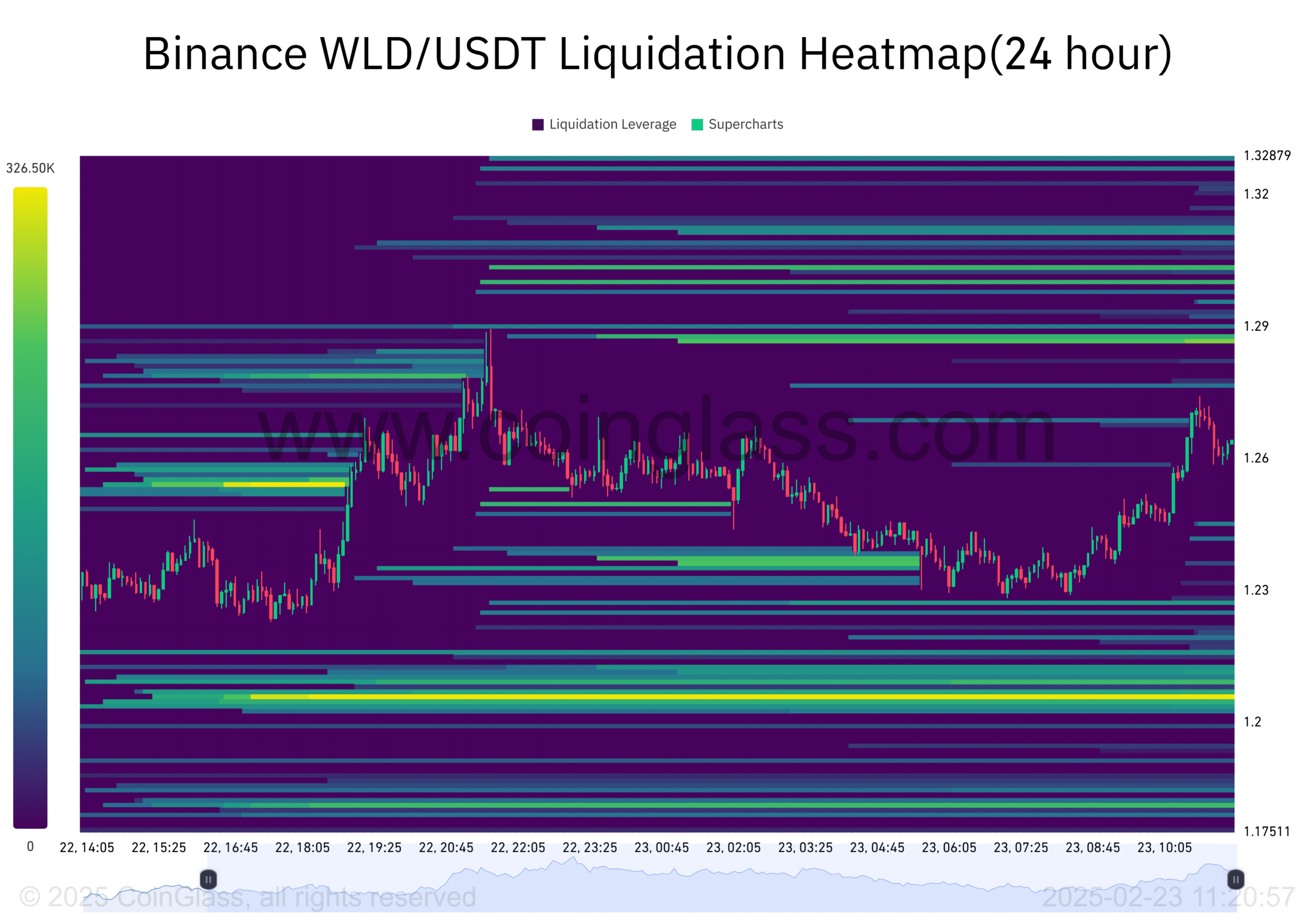

Is a short squeeze on the horizon?

Looking at WLD’s Liquidation heatmap, there’s a noticeable concentration of liquidation activity around the $1.26–$1.30 price point.

If the price keeps moving upwards from where it is now, we could see even more short positions being forced to liquidate. This could really crank up the price volatility.

This whole situation could trigger a short squeeze, which would mean even faster upward momentum.

So, the way price acts around this level is super important. Traders should be ready for any quick price swings – that could be the signal that a short squeeze is kicking off.

Source: Coinglass

Will Worldcoin break out or continue down?

Overall, Worldcoin is showing some promising signals for potential growth as it gets closer to key resistance levels. The fact that we’re seeing more active addresses and a retail transaction surge really points to growing interest and positive vibes around the project.

Plus, when you consider the liquidation heatmap hinting at a possible short squeeze, it looks like there’s potential for prices to jump even higher.

So, all things considered, it’s looking like WLD might be ready to shake off its recent downtrend and test higher prices, maybe even reaching targets somewhere between $1.34 and $2.80.