XRP, ADA, DOGE Lead $1 Billion Crypto Liquidation Tsunami

XRP, ADA, DOGE Lead $1 Billion Crypto Liquidation Tsunami

Crypto traders are feeling the pain again. China’s latest move – tariffs on nearly $22 billion of US agricultural goods – sent shockwaves through the markets. It wasn’t pretty. The S&P 500 took a tumble, and the crypto market… well, let’s just say four months of gains vanished in a flash.

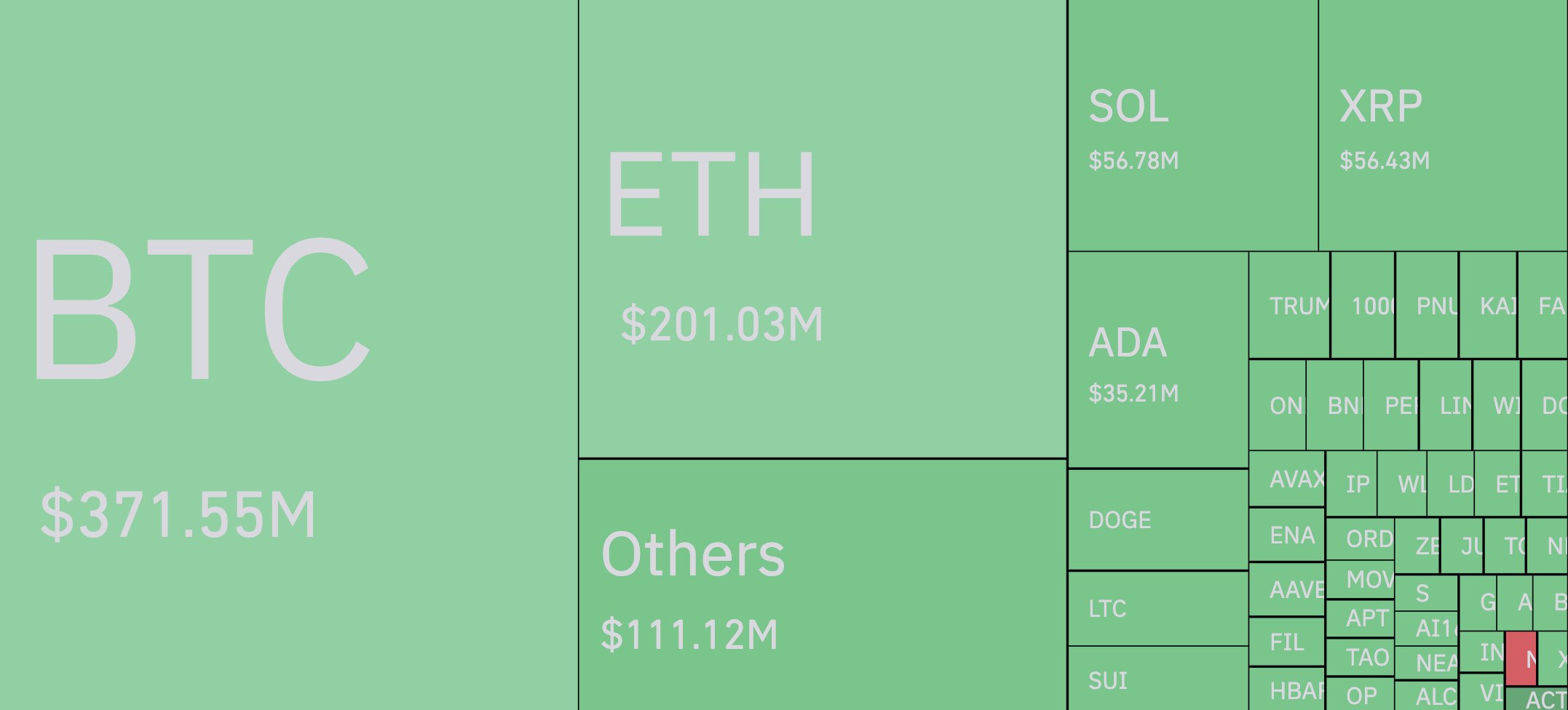

And the liquidations? They exploded. In a single 24-hour period, the crypto market saw a staggering $1 billion wiped out in liquidations, according to data from CoinGlass. Ouch. And to add insult to injury, most of this pain was felt by those betting on crypto going up – long positions were hammered. XRP, Cardano (ADA), and Dogecoin bulls especially felt the sting. In fact, around 70% of the liquidations were longs, with only 30% shorts. It’s a stark reminder of how quickly leverage can turn against you in the crypto world.

But let’s be clear, this wasn’t *just* a crypto meltdown. The traditional markets were feeling the pressure too. The S&P 500’s decline mirrored a wider sense of unease in the market – worries about trade wars, economic clouds on the horizon, and a resurgent ‘risk-off’ mood. It all created a snowball effect of selling. And crypto, still very much connected to these wider economic trends, got caught in the downdraft.

XRP, ADA, DOGE – these were the darlings of recent weeks, building up steady gains. But that upward drive has been slammed into reverse, at least for the moment. The liquidation cascade ripped through leveraged positions, leaving traders scrambling to re-evaluate their risk.